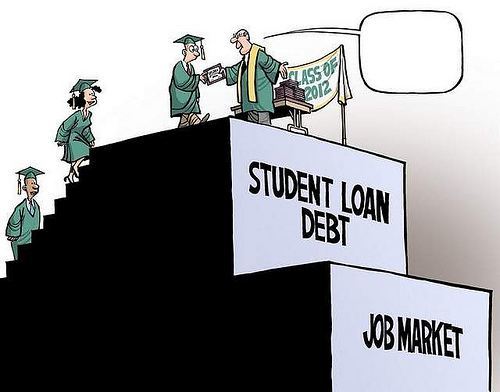

College is supposed to be the most memorable time of our lives. These are the years when we’re young, carefree, and ready to take on things as they come. And while a lot of students do spend their college lives in a happy bliss, for many more, it is not as easy. While government educational institutions in India are extremely affordable, they are not accessible for all due to limited seats.

Tuition costs are alarmingly high all over the world but it is an increasing trend in India as well. Admission is not a straightforward procedure as multiple students gain admission through the management quota which is essentially, paying extra to get a seat. The per semester fee is an enormous amount and it further includes the cost of accommodation, food, transportation, study material and necessities.

With a large number of state universities failing to provide quality education, most students prefer to move to the major metropolitan cities for higher education. The cost of staying in these metropolitan cities is so huge that many students prefer to drop out of college rather than burdening their families with the cost. Over the years, Indian banks have seen more than 140% rise in failure of loan repayment taken by students.

The demand for loans has increased with the increase in management and engineering colleges popping up all over the country, without a quality assessment and certification. While it is fair for students to be granted education loans, the fact that these institutions fail to provide quality education results in their students not getting employed. This then results in a failure in repayment of loans as the amount of money earned, nowhere compensates for the amount of money borrowed.

A major part of the problem is that while student loans are quite easy to obtain, many students do not understand how repayment works. There is a need for educating and making students aware about the repayment process and the provision of financial advisors who can guide them through the process. The lack of knowledge, and uncertainty, adds to the stress in students. Part time jobs are one method to assist the repayment process but they should be relevant to their course of study and there should be a provision for on-campus jobs to reduce the cost of transportation. There are also multiple ways of repayment such as graduated repayment and extended repayment, the understanding of which makes it easier to give the amount back.

Regulation becomes an important step in battling this problem and has to be adopted in all areas of the education system. Firstly, the amount of universities that are being established all over the country needs to be regulated. While these do grant more opportunities and seats to aspiring students, they do not administer quality of education and employability. Secondly, regulation is needed by banks in the sense that when the loan is granted, they should assess the course, employability and student capacity. This will ensure that the student enrolls in the right course and is assured employment at the completion of the degree. And most importantly, for the benefit of students themselves, educational institutions need to be regulated against charging high fees in the direct fee structure, hostel accommodation and other added costs.

Which the issue of student loan debt is a huge one, it is not one that cannot be solved. With steady efforts at awareness and reformation, policy makers and students can surely overcome it.